The Ultimate Overview to Comprehending Various Insurance Plan

Wiki Article

How to Pick the Right Insurance Coverage for Your Requirements: Vital Tips

Selecting the suitable insurance protection is a crucial choice that needs mindful factor to consider of your individual circumstances and possible threats. Additionally, recognizing the subtleties of various insurance policy kinds and comparing quotes from numerous companies can significantly influence your financial safety.

Evaluate Your Insurance Coverage Demands

Evaluating your protection needs is a crucial action in making educated insurance decisions. This procedure includes assessing both your existing scenarios and potential future situations to establish the ideal kinds and amounts of insurance coverage called for. Begin by recognizing your possessions, consisting of property, cost savings, and financial investments, as these elements will certainly influence the degree of security you need to look for.Following, consider your personal situations, such as household dimension, dependents, and wellness conditions. These variables can dramatically influence your insurance needs, specifically in areas like life and health and wellness insurance coverage. Additionally, reflect on your way of life, including career dangers and pastimes, which may require customized insurance coverage.

It is additionally vital to make up any existing plans you may hold. Understanding your existing protection will certainly assist determine gaps and prevent unneeded duplication. Examine prospective responsibilities, such as residential or commercial property damage or personal injury risks, to guarantee you have ample obligation protection.

Study Different Insurance Coverage Kinds

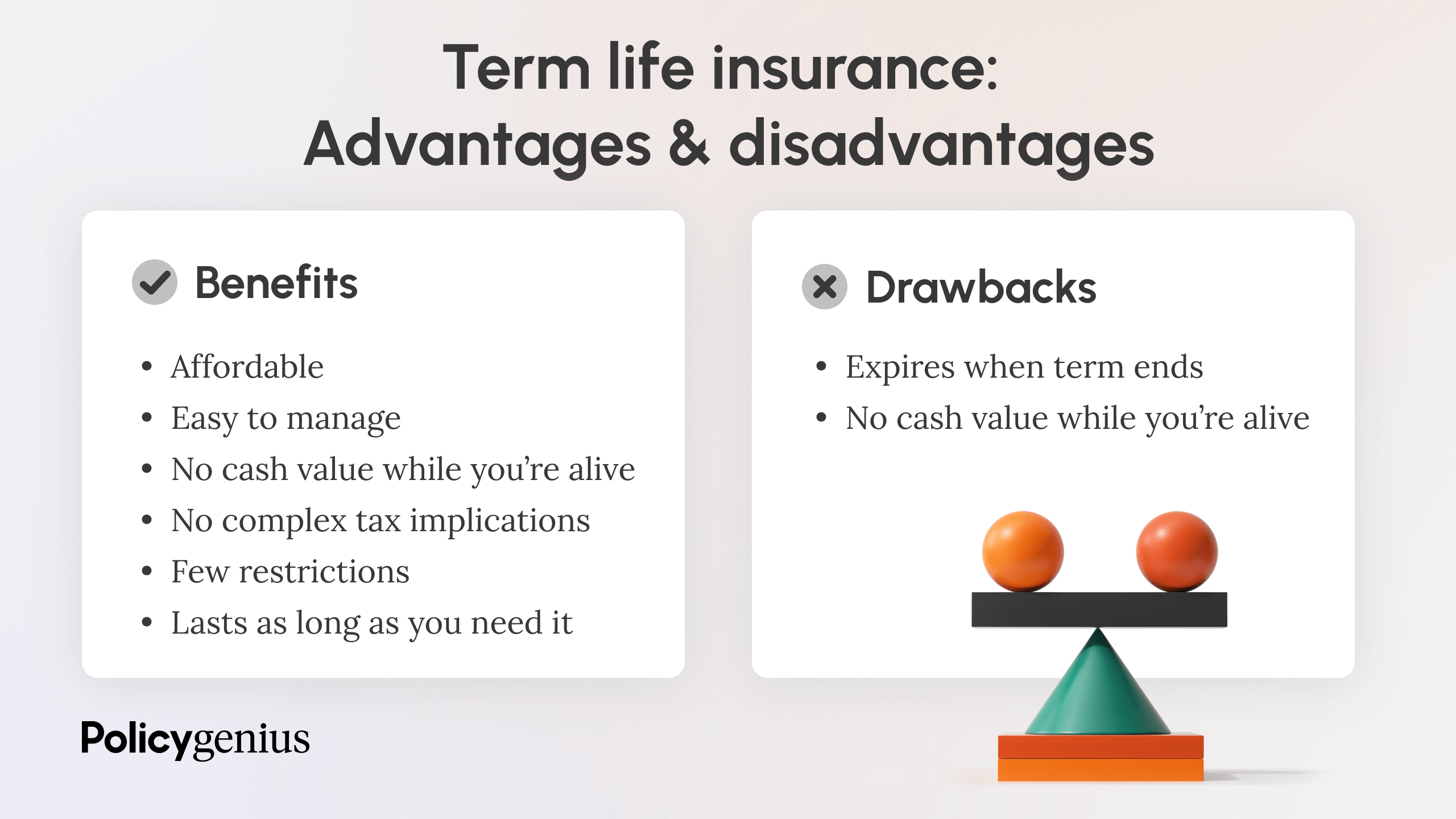

Discovering different insurance kinds is crucial for ensuring comprehensive coverage tailored to your demands. Comprehending the basic groups of insurance policy can substantially impact your decision-making process. The primary types consist of wellness, auto, home, life, and disability insurance, each serving special objectives.Medical insurance covers clinical expenditures and is important for taking care of health care expenses. Vehicle insurance offers defense against vehicle-related occurrences, consisting of accidents and theft. Home insurance coverage safeguards your building and possessions from damage or loss due to unpredicted events like all-natural calamities or burglary.

Life insurance policy ensures financial security for your dependents in the event of your passing, while special needs insurance policy offers revenue replacement if you can not function due to illness or injury. It is likewise necessary to take into consideration specific insurance coverage products, such as tenants, travel, and pet dog insurance, relying on your lifestyle and circumstances.

Compare Quotes From Providers

Once you have determined the sorts of insurance that suit your demands, the following action is to contrast quotes from different companies. Collecting several quotes is crucial, as it enables you to assess the market and determine affordable pricing. Beginning by asking for quotes from trustworthy insurance firms, either straight through their internet sites or by utilizing contrast sites that accumulated information from multiple insurance providers.As you accumulate quotes, take note of the coverage details and restricts given, as these can vary substantially between policies. Guarantee you are comparing similar protection amounts and deductibles to make an exact assessment - insurance. Furthermore, take into consideration the economic stamina and customer support reputation of each company. Looking into customer testimonials and rankings can provide you understanding into the dependability and responsiveness of the insurance firm.

While cost is an essential Go Here element, it needs to not be the single determinant in your decision-making procedure. A reduced costs might come at the cost of vital insurance coverage or support. By thoroughly contrasting quotes, you can discover an equilibrium between price and detailed security customized to your specific needs. This strategic strategy will equip you to make an educated choice regarding your insurance coverage.

Understand Policy Conditions and terms

Comprehending the details of plan conditions is vital for making educated insurance policy choices - insurance. Each insurance policy features its own set of terms that lay out the coverage given, exclusions, restrictions, and the obligations of both the insurer and the guaranteedBegin by meticulously reviewing the affirmations page, which sums up essential information such as coverage restrictions and deductibles. Pay very close attention to the interpretations section, as it clears up particular terms that could affect your understanding of the plan.

Following, determine the coverage types consisted of in the policy. This might encompass responsibility, home damages, or health wikipedia reference costs, relying on the insurance coverage kind. Check out the exemptions and limitations, as these define circumstances or problems that are not covered. Understanding these facets can prevent unexpected monetary concerns during an insurance claim.

If Essential,## Look For Expert Recommendations.

Navigating the complexities of insurance coverage can be frustrating, and seeking specialist recommendations can supply clarity. Insurance coverage specialists have the experience essential to examine your certain needs and recommend appropriate coverage options. They can aid you the original source recognize detailed terms, exemptions, and endorsements that might substantially influence your plan's performance.

When considering expert assistance, it is important to choose someone with relevant experience in your area of demand-- be it wellness, auto, or home owners insurance coverage. A certified agent or broker can aid in comparing multiple policies from various insurance companies, ensuring you make an informed choice. Furthermore, they can give understandings right into market patterns and transforming laws that might impact your coverage.

Furthermore, expert experts can assist you analyze prospective dangers and advise techniques to mitigate them, ensuring you are adequately protected. This tailored method can save you time and potentially money by avoiding costly blunders or voids in insurance coverage.

Conclusion

To conclude, selecting the appropriate insurance policy calls for a comprehensive examination of protection needs, thorough study into numerous insurance policy kinds, and cautious comparison of quotes from several carriers. Comprehending the intricacies of policy terms and problems is necessary to protect against unforeseen expenditures. For individuals dealing with complicated circumstances, acquiring specialist recommendations can supply tailored insights and suggestions. Inevitably, a methodical strategy makes certain that insurance coverage selections align with particular requirements and sufficiently safeguard versus possible dangers.Selecting the ideal insurance policy protection is an essential decision that requires cautious consideration of your prospective dangers and individual circumstances.Analyzing your protection requires is an important action in making educated insurance policy choices.Discovering different insurance coverage types is crucial for ensuring comprehensive coverage customized to your demands. Insurance coverage professionals possess the proficiency needed to review your certain requirements and suggest proper protection options.In final thought, picking the appropriate insurance policy calls for an extensive analysis of coverage needs, diligent study into numerous insurance coverage kinds, and cautious contrast of quotes from numerous companies.

Report this wiki page